İçindekiler

Ortak Bir İkilem

Birkaç hafta önce yayınladığımız bir makale Mevcut Bitcoin boğa koşusunu teşvik eden tüm farklı kuyruk rüzgarlarını araştırmak. Bu yazıda, değişen düzenleyici ortam ve yatırım eğilimleri göz önüne alındığında, bu döngünün Bitcoin için özellikle iyi olabileceğini savunduk. Ancak yatırımcılar yine de bu fırsattan en iyi nasıl yararlanabileceklerini merak edebilirler. Bitcoin madenciliğine yatırım yapmak mı yoksa doğrudan Bitcoin satın almak mı daha iyi? Elbette, her ikisi de kâr elde etmek için uygun yollardır ve birbirleriyle oldukça ilişkilidirler. Ancak, bu iki yatırımın önemli ölçüde farklılık gösteren yönleri vardır.

Bitcoin madenciliği yatırımı istikrarlı bir gelir akışı sağlarken, doğrudan Bitcoin yatırımı herhangi bir nakit akışı yaratmaz. Bu da Bitcoin yatırımından elde edilebilecek tek olası kârın varlıkların değer kazanmasından gelmesini sağlar. Bu fark nedeniyle, belirli koşullar bir seçeneği diğerinden daha karlı hale getirebilir. Bu makalede, özellikle mevcut piyasa koşullarında Bitcoin madenciliğine yatırım yapmanın neden doğrudan Bitcoin yatırımından daha fazla kâr sağlayabileceğini inceleyeceğiz.

Madencilik Ne Zaman Bitcoin Satın Almaktan Daha İyidir?

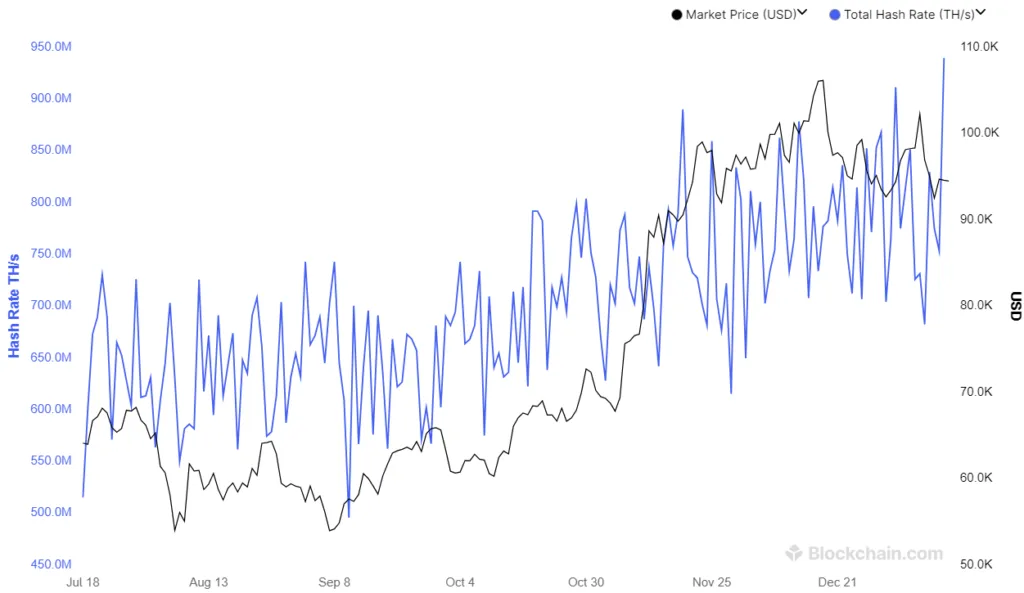

Bitcoin madenciliğinin doğrudan satın almaya kıyasla karlılığı, mevcut piyasa eğilimlerinin yanı sıra hash oranı gibi diğer ağ değişkenlerine de bağlıdır. Yükselen piyasalarda, Bitcoin'in fiyatı ağın hash oranından çok daha hızlı yükselebilir. Bunun nedeni Bitcoin fiyatının piyasa tüccarları tarafından yönlendirilirken hash oranının artmasının yeni donanım ve altyapının kullanılmasına bağlı olmasıdır. Bitcoin fiyatı madencilik zorluğunu aştığında, madenciler büyük kazanç elde eder. Fiyat arttıkça, gelirler maliyetlerden daha hızlı artar ve kar marjları yükselir. Aslında, boğa koşusu sırasında, bu marjlar genellikle Bitcoin fiyatından bile daha hızlı büyür.

Bu nedenle, Bitcoin madenciliğine yatırım yapmak, fiyatın yakın gelecekte bir noktada hızlı bir şekilde yükselmeye başlayacağını tahmin ederken özel bir anlam ifade eder. Bu, ayı piyasasının son aşamalarında veya piyasa konsolide olurken olabilir. Bunlar, piyasaların soğuk olduğu ve madencilik makinelerine olan talebi düşürdüğü dönemlerdir. Bu durum madencilerin makul fiyatlarla ekipman edinmesine olanak tanıyarak piyasalar yeniden hareketlendiğinde büyük kârlar elde etmelerini sağlayacaktır.

Bitcoin Madenciliğine Yatırım Yapmanın Diğer Avantajları

Ancak, zamanlama bir yana, doğrudan Bitcoin'e yatırım yapmak yerine madenciliğe yatırım yapmanın başka avantajları da vardır. Madenciler, elektrik maliyetleri ve madencilik zorluğuna göre belirlenen ve yavaşça değişen bir maliyetle zaman içinde Bitcoin biriktirir. Madencinin ucuz elektriğe erişimi varsa, her bir Bitcoin'i çıkarmanın maliyeti piyasa fiyatından önemli ölçüde daha düşük olabilir. Ekipman ve altyapı maliyetleri karşılandıktan sonra, bu madenciler Bitcoin'i diğer herkesten daha ucuza elde edebilirler. Bu durum, piyasa koşullarından bağımsız olarak, Bitcoin çıkarma maliyetleri mevcut Bitcoin fiyatının altında kaldığı sürece geçerlidir.

Dahası, doğrudan Bitcoin yatırımı daha riskli olabilir çünkü satın alma anındaki piyasa koşullarına bağlı olarak fazla ödeme yapma riski vardır. Bundan kaçınmak için, mantıklı bir yatırımcı satın alımlarını uzun bir süre boyunca DCA yapmaya karar verebilir. Bunu yaparak madencilerin Bitcoin edinme yöntemini taklit etmiş olurlar.

Mevcut Piyasa Koşulları

Bitcoin'in fiyatı son iki aydır $90,000 ile $110,000 arasında sabit kaldı ve ABD seçim döneminin tetiklediği boğa koşusunun ardından bir konsolidasyon aşamasına işaret etti. Bu, Bitcoin'in iki haftadan biraz daha uzun bir sürede $65,000'den neredeyse $100,000'e yükselmesi nedeniyle biriken aşırı kaldıraca karşı doğal bir piyasa tepkisidir. Geçmişteki boğa koşuları da benzer konsolidasyon modellerine sahipti ve genellikle fiyat yükseliş eğilimine devam ettiğinde büyük bir fiyat hareketi izliyordu. Bu düzeltme madencilerin kendilerini konumlandırmaları için iyi bir fırsat yarattı.

Birçok analist bu konsolidasyon aşamasının bu yıl içinde yeni bir boğa koşusuna yol açabileceği konusunda hemfikir. Dahası, daha önce de belirttiğimiz gibi geçen ayki̇ makalebu döngü özel olabilir. Amerika Birleşik Devletleri'nde yakında gerçekleşecek mevzuat değişiklikleri ve şirketler ile ulus devletlerin rezerv biriktirmesi, bu boğa koşusunu beklenenden daha uzun süre devam ettirebilir. Yatırımcılar madenciliğe şimdi katılarak daha düşük giriş fiyatının keyfini çıkarabilir ve potansiyel olarak gelecekteki fiyat artışlarından büyük ölçüde kâr edebilirler.

Sonuç: Madencilik Neden Şu Anda Muhtemelen Daha Akıllıca Bir Seçim?

Günümüzün piyasa koşulları Bitcoin madenciliği için ideal bir ortam yaratıyor. Mevcut fiyat düzeltmesi, madencilerin ekipman edinmelerine ve Bitcoin'i sabit, öngörülebilir bir maliyetle çıkarmalarına olanak sağlarken, piyasayı zamanlama risklerinden de kaçınıyor. Yatırımcılar için bu konsolidasyon dönemi iyi bir fırsat sunuyor. Ufukta başka bir boğa koşusu potansiyeli varken, madencilik yatırımları önümüzdeki aylarda Bitcoin'den büyük ölçüde daha iyi performans gösterebilir.

Dahası, Bitcoin'i piyasadan daha düşük bir fiyata elde etme kapasitesi sayesinde madenciler piyasa düzeltmeleri ve ayı piyasaları sırasında bile kâr elde edebilmektedir. Madencilik, özellikle fiyat durgunluğu veya gerileme dönemlerinde değerli olabilen Bitcoin'in istikrarlı bir şekilde birikmesine olanak tanır. Ayrıca, bugün yapılan altyapı yatırımları piyasa koşulları değişse bile gelecek yıllarda da getiri sağlamaya devam edebileceğinden madencilik uzun vadeli değer yaratmayı teşvik eder.