Contents

- Network Overview

- Bitcoin Miners Log Strongest Month Since Halving, Says JP Morgan

- Solo Bitcoin Mining Makes Headlines Again

- Sanctioned States Suspected of Mining Bitcoin in Secret

- MARA Buys $73M in Bitcoin Miners From Auradine in Strategic U.S. Pivot

- London Bitcoin Company Surpasses 1,000 Miners Across North America

- Russia Orders Data Centers to Report Crypto Miners’ Tax Info to State

- Top 10 Miners Control 94% of Hashrate and Hold Over $6.5B in Bitcoin

- Bitcoin Mining Difficulty Hits All-Time High, Drop Expected Soon

Network Overview

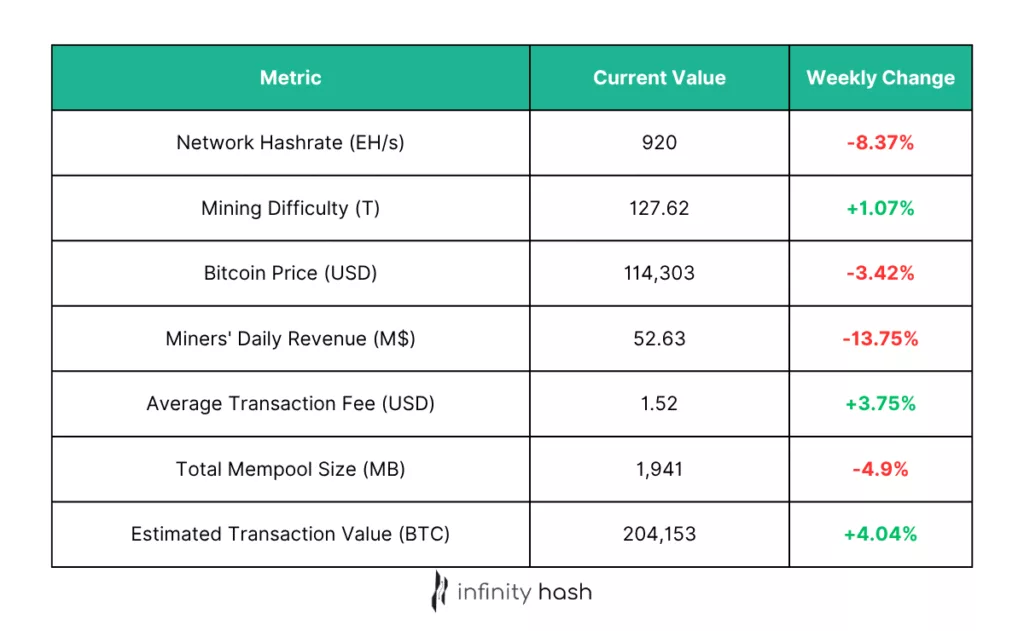

After weeks of relentless growth, the Bitcoin mining network finally showed signs of cooling. Hashrate dropped significantly, even as difficulty edged higher. This mismatch suggests some miners have begun powering down unprofitable machines, unable to keep pace with operational costs in the face of weaker BTC prices and higher difficulty.

That stress is reflected in the -13.75% plunge in miner revenue. Still, rising transaction fees and a bump in estimated transaction value hint at a more active mempool, offering a small cushion amid the pressure. If this downtrend in hashrate continues, we may be just a few days away from a sizable difficulty adjustment, potentially offering a much-needed breather to the mining sector. For now, it is expected that the adjustment will take place on Saturday, and will bring a small difficulty reduction.

Bitcoin Miners Log Strongest Month Since Halving, Says JP Morgan

Bitcoin miners earned an average of $57,400 per EH/s per day in July, marking their most profitable month since the April 2024 halving, according to JP Morgan analysts. The strong performance was driven by BTC hitting an all-time high of $122,838 during the month, helping ten of the thirteen tracked mining firms outperform the coin itself in percentage terms.

However, despite the improved revenue, mining profitability remains well below pre-halving levels. Operational challenges continue, including higher energy costs, increased difficulty, and lower block rewards. JP Morgan noted that daily revenue and gross profit per EH/s are still down 43% and 50% compared to before the halving.

Source: decrypt.co

Solo Bitcoin Mining Makes Headlines Again

Despite Bitcoin’s hashrate hovering near record levels of 902 EH/s at the time of writing, several solo miners have recently succeeded in winning full block rewards. One miner using the Solo CK pool earned 3.125 BTC (over $372,000) plus $3,436 in fees by solving block 907,283, while others with only a few PH/s have achieved similar wins throughout 2025. Experts point to the increased efficiency of modern ASICs, which can deliver serious hashrate even in small-scale setups, though they caution that solo mining remains a high-stakes lottery.

The trend is being driven by both financial and ideological motives. While some miners are chasing the chance of a life-changing reward, others view solo mining as a way to support network decentralization and avoid overreliance on dominant pools like Foundry USA, AntPool, and ViaBTC. Samuel Li of ASICKey emphasized that a healthier Bitcoin ecosystem may ultimately require more small-scale participants running efficient hardware and renewable energy sources.

Source: cointelegraph.com

Sanctioned States Suspected of Mining Bitcoin in Secret

According to HIVE Digital co-founder Frank Holmes, several countries facing U.S. sanctions are covertly mining Bitcoin as a means of bypassing financial restrictions. Speaking in a recent interview, Holmes linked fluctuations in Bitcoin’s global hashrate to geopolitical events, such as military strikes on Iranian infrastructure, suggesting that power disruptions have impacted state-sponsored mining efforts. He noted that Bitcoin offers these nations a way to accumulate wealth independently of the U.S.-dominated financial system, positioning BTC as a strategic asset in economic warfare.

Meanwhile, HIVE Digital is expanding its operations in more politically stable and U.S.-friendly countries. The company recently acquired new infrastructure in Paraguay and is aiming to scale from 14 EH/s to 25 EH/s by November. With projected annualized revenue of $315 million, HIVE is positioning itself as a top-tier miner, prioritizing growth in jurisdictions with favorable regulation and energy resources. Holmes emphasized that Bitcoin mining is quickly becoming a geopolitical tool.

Source: cryptoslate.com

MARA Buys $73M in Bitcoin Miners From Auradine in Strategic U.S. Pivot

Bitcoin mining giant MARA purchased $73.3 million worth of Teraflux miners from U.S.-based chip startup Auradine in the first half of 2025, according to its Q2 earnings report. The orders, fully prepaid and fulfilled by June 30, represented a large portion of MARA’s $108 million in vendor advances. The company still has $51.4 million in pending commitments with Auradine for the rest of the year.

Beyond hardware, MARA has deepened its relationship with Auradine through equity investments totaling $85.4 million and now holds a seat on the company’s board. This marks a strategic shift away from dependence on Bitmain, whose machines once dominated MARA’s fleet. As U.S.-China trade tensions escalate, MARA’s move shows a clear preference for domestically manufactured mining equipment.

Source: news.bitcoin.com

London Bitcoin Company Surpasses 1,000 Miners Across North America

London Bitcoin Company announced it now operates over 1,000 active Bitcoin miners across multiple North American locations, marking what it called a “major operational milestone.” The total includes 385 new ASICs deployed to its Indiana site, now its largest with 525 machines. Other facilities are located in Texas, Iowa, Nebraska, and Canada’s Goose Bay, with a combined uptime of 94% and 100 PH/s of hashrate.

CEO Hewie Rattray emphasized that mining is central to the firm’s broader Bitcoin-denominated strategy. As a publicly listed treasury company with no debt and a significant BTC reserve, London BTC aims to earn native yield while staying aligned with the long-term design of the Bitcoin network. Its corporate structure, domiciled in the BVI, also provides regulatory and tax advantages as it scales further.

Source: coinfomania.com

Russia Orders Data Centers to Report Crypto Miners’ Tax Info to State

Effective July 30, Russian data centers and hosting providers must submit detailed reports on all crypto miners using their infrastructure to the Federal Tax Service (FNS). The move is part of the state’s effort to regulate and potentially limit energy use in digital asset mining. The new form requires operators to disclose information like electricity tariffs, equipment models, usage hours, mining algorithms, and even real-time monitoring links.

This follows Russia’s 2024 decision to legalize Bitcoin mining for registered businesses. However, concerns over unregistered operations and regional energy shortages have led to a push for stricter oversight. Noncompliance could result in penalties or deregistration. The legislation also comes amid broader efforts to prioritize computing power for domestic AI and big data development.

Source: cryptopolitan.com

Top 10 Miners Control 94% of Hashrate and Hold Over $6.5B in Bitcoin

New data reveals that the top 10 Bitcoin mining pools now control 94.2% of global hashrate and collectively hold over 55,000 BTC, worth approximately $6.52 billion. Leading the pack is Foundry with 30.88% of network power, followed by Antpool (20.49%), ViaBTC (13.65%), and F2Pool (10.42%). Some, like MARA, also operate as treasuries. MARA alone holds 50,000 BTC, with 11,034 BTC in mining-specific wallets.

These figures illustrate miners’ evolving role: not just as validators, but as powerful financial players stockpiling BTC as strategic assets. Many transact regularly with custodians like Coinbase, Cobo, and NYDIG. The hoarding trend could cause centralization risks emerging from a tightly held mining ecosystem.

Source: news.bitcoin.com

Bitcoin Mining Difficulty Hits All-Time High, Drop Expected Soon

Bitcoin’s mining difficulty reached a record high of 127.6 trillion this week, evidencing intense competition among miners. However, projections suggest a 3% drop to 123.7 trillion at the upcoming difficulty adjustment on August 9. The adjustment mechanism ensures BTC is mined at a steady rate of around one block every 10 minutes, despite changes in hashrate.

This record high follows a dip in June and early July, before difficulty resumed its long-term uptrend. Analysts tie these dynamics to Bitcoin’s stock-to-flow model, which emphasizes the importance of scarcity. With 94% of BTC already mined, and difficulty adjusting to prevent overproduction, Bitcoin remains more scarce than even gold.

Source: cointelegraph.com