İçindekiler

- Ağa Genel Bakış

- Hive Digital Expands in Paraguay, Surpasses 18 EH/s

- Ethiopia Converts Surplus Hydropower Into Bitcoin Revenue

- Monero Hit by Largest Chain Reorg in History

- Brazil Cracks Down on Illegal Crypto Mining in Rio de Janeiro

- Hong Kong Police Arrest Two for Mining Crypto in Care Homes

- US Lawmaker Pushes for National Security Review of Bitmain and Canaan

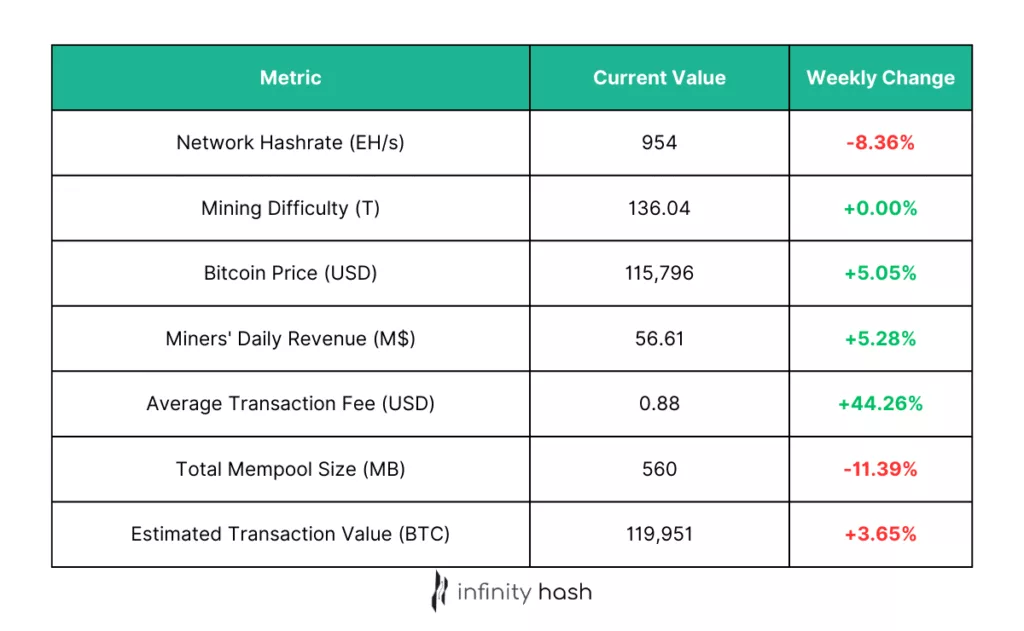

Ağa Genel Bakış

After weeks of muted miner revenue, this week brought a rebound thanks to positive Bitcoin price action combined with slightly higher fee income. Still, the squeeze of recent weeks appears to have pushed some operators offline, as reflected in a dip in network hashrate. On-chain settlement value stayed elevated, consistent with larger transfers moving through the network. This is likely due to treasury rebalancing and profit-taking after the prior drawdown, while mempool noise didn’t translate into a processing bottleneck.

Structurally, the backdrop remains mixed for operators: efficiency and cheap power still win as new hydro and modular deployments come online (e.g., rapid buildouts like Hive’s Paraguay site and “Proto Rig”-style modularity). At the same time, tariffs, and other costs keep pressure on margins, leaving little room for underperforming setups.

Hive Digital Expands in Paraguay, Surpasses 18 EH/s

Hive Digital has completed the second phase of its Yguazú mining facility in Paraguay, boosting its hashrate to 18 EH/s and daily production to more than 8.5 BTC. The 200 MW site, powered by hydroelectric energy from the Itaipu dam, is the company’s largest installation and was completed ahead of schedule. It uses Bitmain S21+ Hydro ASIC miners with advanced water-based cooling, reflecting Hive’s push for efficiency and sustainability.

The company also reported progress at its Valenzuela site, where 100 MW of capacity is prepared for incoming hardware. Hive aims to cross the 25 EH/s milestone by Thanksgiving, which would lift daily production toward 12 BTC. Executives framed the Paraguay operations as central to Hive’s broader growth strategy, which seeks to pair renewable energy with scalable infrastructure to secure long-term competitiveness.

Kaynak: news.bitcoin.com

Ethiopia Converts Surplus Hydropower Into Bitcoin Revenue

Ethiopia has begun channeling excess capacity from its Grand Renaissance Dam and other hydro projects into Bitcoin mining, turning otherwise stranded power into hard currency. Ethiopian Electric Power sells electricity to miners at roughly $0.03–0.04 per kWh, which has generated around $55 million in foreign currency inflows over the past ten months. The government sees the model as a way to fund infrastructure and accelerate universal electrification.

The program has also drawn international mining firms to Addis Ababa and surrounding areas, creating jobs and transferring technical skills. Still, authorities have capped new permits to avoid stressing the domestic grid, with analysts warning that mining could consume up to 8 TWh this year. By balancing regulation with investment, Ethiopia is positioning itself alongside Paraguay, Kenya, and Zambia as a leading example of hydropower-backed Bitcoin mining.

Kaynak: coinfomania.com

Monero Hit by Largest Chain Reorg in History

Privacy coin Monero (XMR) has come under renewed attack, suffering its largest-ever chain reorganization. The incident triggered an 18-block reorg that invalidated 118 transactions, raising concerns over network stability and double-spend risks. Security firm SlowMist compared the threat to a “sword of Damocles,” warning that such vulnerabilities can be exploited without a full 51% hashrate advantage. Users are now being urged to wait for more confirmations than the standard 10 before accepting XMR payments.

The scale of disruption is unprecedented for Monero. Data shows 108 orphaned blocks in the past 720, with over 14% of blocks traced to unknown miners. This pushed the orphan rate to 30% — vastly above Monero’s typical 1–3% range and even higher than the 8.3% peak during the previous Qubic-related instability. The abnormal activity highlights systemic risks facing the network if such attacks persist, underscoring the fragility of smaller Proof-of-Work ecosystems when faced with concentrated hashrate disruptions.

Kaynak: bitcoinsistemi.com

Brazil Cracks Down on Illegal Crypto Mining in Rio de Janeiro

Police in Rio de Janeiro have arrested a man accused of running a large-scale illegal crypto mining operation on Governador Island. The suspect allegedly siphoned off-grid electricity to power several high-performance machines in a rented property operating 24/7 without a meter. Authorities confirmed the setup was designed solely for cryptocurrency mining, and the individual now faces charges of electricity theft.

While grassroots mining remains legal in Brazil, the country’s ruling Workers Party is pushing to restrict operations to licensed, regulated entities under a Digital Miner Authorization License. The case underscores a wider trend of enforcement, with São Paulo also seeing recent raids. Similar crackdowns have taken place across South America, where Paraguay has reported $60 million in utility losses from electricity theft, and Venezuela has shuttered unlicensed miners. Globally, illegal mining operations continue to surface, from Malaysia and Kuwait to Hong Kong, where two men were arrested this week for diverting power from care homes.

Kaynak: decrypt.co

Hong Kong Police Arrest Two for Mining Crypto in Care Homes

Hong Kong police have arrested two men accused of secretly installing cryptocurrency mining rigs in care homes for the disabled. Investigators allege the technicians, aged 32 and 33, used their access during renovation work to conceal eight machines in office ceilings, running them continuously and inflating monthly electricity bills by up to $1,153. The case surfaced after one home’s IT staff noticed persistent internet slowdowns and uncovered the hidden devices.

Authorities charged the pair with electricity theft under Hong Kong’s Theft Ordinance, which carries a maximum five-year sentence. Officials stressed the need for organisations to monitor contractors and energy bills closely, as concealed rigs can remain undetected for months. The incident adds to a growing wave of illegal mining cases worldwide, from Malaysia to Central Asia, highlighting the risks of energy theft and its strain on grids.

Kaynak: decrypt.co

US Lawmaker Pushes for National Security Review of Bitmain and Canaan

Representative Zach Nunn has raised alarms over the expansion of Chinese mining hardware giants Bitmain and Canaan into the United States, citing “opaque governance structures and financing methods.” His concerns focus on the potential for hidden state influence and the risks of foreign control over what is increasingly seen as strategic digital infrastructure.

Nunn is calling for a review by the Committee on Foreign Investment in the United States (CFIUS), which has the authority to scrutinize foreign involvement in critical industries. A CFIUS probe could force operational changes, divestments, or restrictions on the firms’ U.S. presence. Analysts warn the outcome could set a precedent for how Washington regulates foreign participation in Bitcoin mining and might accelerate efforts to localize hardware supply chains.

Kaynak: bitcoinworld.co.in