İçindekiler

- Ağa Genel Bakış

- Bitcoin Mining Difficulty Jumps Nearly 8%, Squeezing Payouts

- Satoshi’s Bitcoin Mining Costs Estimated to Be Under $4,000

- Russia Launches National Crypto Mining Registry to Target Illegal Operations

- CoreWeave to Acquire Core Scientific in $20.40 Per Share All-Stock Deal

- Bitdeer Joins Russell Indexes and Surges Operational Capacity Amid Hardware Breakthrough

- Tether Aims to Become World’s Largest Bitcoin Miner by End of 2025

- KULR Expands Bitcoin Mining Operations in Paraguay with 750 PH/s Milestone

- Russia Moves to Ban Bitcoin Mining in Data Centers to Prioritize AI Development

- Russia and China Gain Ground as U.S. Hashrate Share Slips Slightly

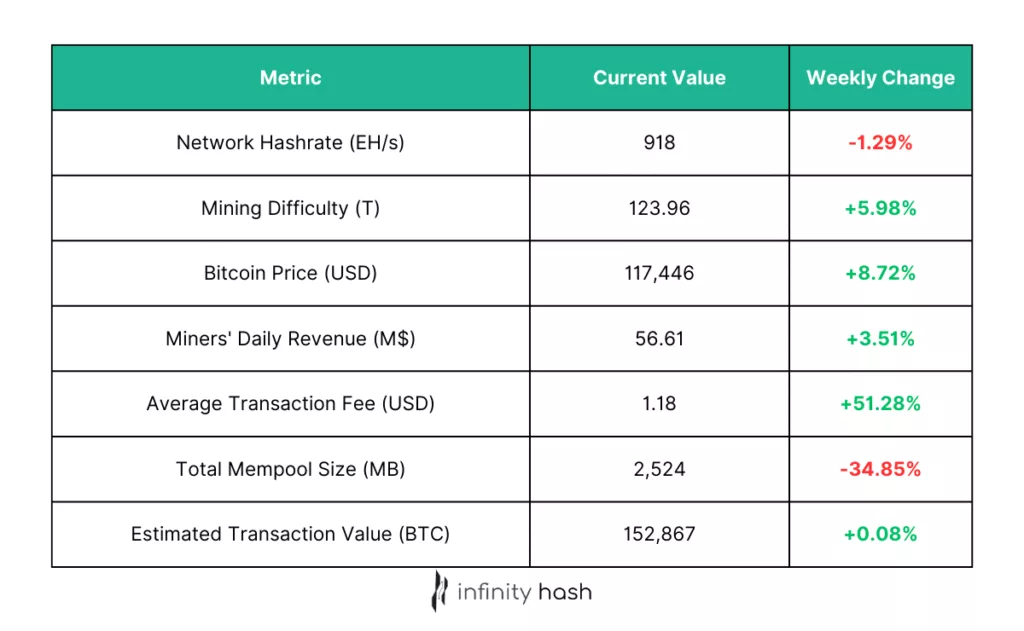

Ağa Genel Bakış

This week’s sharp +6% difficulty adjustment is already starting to bite into profitability. The fee spike helped soften the blow, but it’s not enough to fully offset the difficulty jump. The hashprice continues to feel the squeeze, even as Bitcoin’s price climbs. Although it is too early to make predictions, for the moment the next difficulty adjustment is anticipated to be a reduction. This offers some hope that the extraordinary profitability of last week could make a comeback. Especially if the Bitcoin price boom continues.

Bitcoin Mining Difficulty Jumps Nearly 8%, Squeezing Payouts

On June 12, Bitcoin’s mining difficulty climbed 7.96% to 126.27T at block height 905184, marking the ninth upward adjustment of 2025. This shift made block discovery significantly harder for miners, directly impacting profitability. Hashprice (miners’ revenue per unit of hashpower) dropped from $64.03 to $59.01 per PH/s following the change. The adjustment reflects the network’s rising computational power and may pressure less efficient operations as rewards tighten.

Kaynak: news.bitcoin.com

Satoshi’s Bitcoin Mining Costs Estimated to Be Under $4,000

Charles Hoskinson, co-founder of Cardano, has released new estimates revealing just how little it may have cost Satoshi Nakamoto to mine the first million bitcoins. During Bitcoin’s infancy in 2009–2010, mining difficulty was extremely low and competition was virtually nonexistent. Based on these conditions, Hoskinson presented three scenarios ranging from a single low-power rig running part-time to a more realistic small mining cluster. In the most efficient case, using a 190-watt PC operating 75% of the time over 485 days, Satoshi’s total electricity cost could have been as low as $191.

Even more sophisticated setups, such as the “Patoshi pattern” identified by researcher Sergio Lerner, suggest a cost closer to $575 in the U.S. and up to $1,000 abroad. The highest-end estimate, assuming greater energy usage to maintain competitiveness, still only reaches about $3,700. These figures highlight the staggering profitability of early Bitcoin mining, especially considering that Satoshi’s holdings are now estimated to be worth nearly $120 billion, surpassing even Bill Gates. It’s a stark contrast to today’s mining landscape, where infrastructure and electricity costs have become defining barriers to entry.

Kaynak: u.today

Russia Launches National Crypto Mining Registry to Target Illegal Operations

In an effort to tighten control over the country’s cryptocurrency mining industry, Russia has launched a national registry of mining equipment. The registry, developed by the Ministry of Energy in coordination with the Federal Tax Service and the Ministry of Digital Development, is aimed at identifying unregistered mining operations and enforcing regulatory compliance. Authorities have already distributed the registry to regions with high mining activity, where it will be used to match electricity usage with mining equipment and ensure miners are taxed appropriately. The initiative is part of a broader national strategy to bring the sector under formal regulation while curbing unauthorized power consumption.

The registry complements Russia’s legal framework introduced in 2023, which permits mining by individuals, sole proprietors, and companies, provided they register with tax authorities. However, widespread noncompliance remains an issue, with only 30% of miners officially registered as of June 2025. Authorities have increased enforcement, including shutting down large illegal sites like a 30,000 square meter operation in Krasnoyarsk Krai and investigating cases of bribery and smart home exploitation for covert mining. The government hopes the registry will accelerate efforts to bring the remaining 70% of unregistered miners into the legal fold.

Kaynak: crypto.news

CoreWeave to Acquire Core Scientific in $20.40 Per Share All-Stock Deal

AI infrastructure company CoreWeave has agreed to acquire bitcoin miner Core Scientific in an all-stock transaction valuing the miner at approximately $20.40 per share. The deal, expected to close in Q4 2025, falls within Jefferies’ previously estimated range of $16–$23 per share and represents a push by CoreWeave to vertically integrate its infrastructure operations. By taking direct control of data center assets, CoreWeave aims to reduce dependence on long-term leases and external developers, aligning the move with its broader post-IPO M&A strategy. Despite the premium valuation, Core Scientific shares dropped over 22% to around $14 after the news, while other miners like HUT 8 and Cleanspark also saw notable declines.

Analysts at Jefferies believe the acquisition strengthens CoreWeave’s position in the rapidly consolidating AI and high-performance computing sector. By absorbing Core Scientific’s infrastructure, CoreWeave moves beyond just compute supply, evolving into a full-stack operator with tighter control over capacity expansion. This integration is increasingly critical as demand from AI and cloud-native firms accelerates. The deal may also have been motivated by Core Scientific’s ongoing lease negotiations with other hyperscalers, with CoreWeave acting swiftly to secure access before those agreements were finalized.

Kaynak: coindesk.com

Bitdeer Joins Russell Indexes and Surges Operational Capacity Amid Hardware Breakthrough

Bitcoin cloud mining firm Bitdeer has made a major leap into mainstream finance with its inclusion in the Russell 2000 and 3000 indexes as of June 30. This milestone puts the firm squarely on the radar of institutional investors and index-tracking funds, improving liquidity and market visibility. The move enhances Bitdeer’s credibility within both the traditional financial ecosystem and the crypto space, potentially unlocking a wave of capital inflows as it continues to scale operations.

Operationally, Bitdeer is on a growth trajectory. The firm’s self-mining hashrate jumped 21% to 16.5 EH/s in June, resulting in the mining of 203 BTC, evidence of investment in infrastructure and hardware. Central to this growth is Bitdeer’s upcoming proprietary SEALMINER A3 rig, now nearing mass production. Together, these developments position Bitdeer as a maturing, vertically integrated force in the crypto mining industry, with the potential to reshape the landscape of cloud mining.

Kaynak: bitcoinworld.co.in

Tether Aims to Become World’s Largest Bitcoin Miner by End of 2025

Tether, best known for issuing the USDT stablecoin, is pivoting aggressively into Bitcoin mining, with CEO Paolo Ardoino announcing plans to become the world’s largest miner by the end of 2025. The move aligns with Tether’s broader push into infrastructure; including AI, telecom, and data centers, and is aimed at protecting the Bitcoin network that supports its $10+ billion BTC treasury. Tether has already established over 15 mining facilities, many through partnerships with governments in Latin America such as El Salvador, Paraguay, and Uruguay. Though it hasn’t disclosed its current share of the global hashrate, the scale of its investment shows that Tether is going all in.

At the same time, the recently passed GENIUS Act in the U.S. is forcing Tether to adapt on the regulatory front. The law demands full reserves, AML/KYC compliance, and operational transparency from stablecoin issuers. Tether now faces a crossroads: upgrade USDT to comply, launch a new U.S.-regulated stablecoin, or exit the American market entirely. Ardoino remains optimistic, citing Tether’s existing cooperation with law enforcement and its global reach. But with competitors like USDC ready to seize any regulatory lapse, the company’s future as both a stablecoin leader and Bitcoin mining powerhouse hangs on how well it navigates these twin challenges.

Kaynak: coinpedia.org

KULR Expands Bitcoin Mining Operations in Paraguay with 750 PH/s Milestone

KULR Technology Group has significantly ramped up its Bitcoin mining capacity by deploying 3,570 Bitmain S19 XP machines in Asunción, Paraguay, pushing its global operational hashrate to 750 PH/s. This move is part of KULR’s broader strategy to scale its mining operations, with a target of reaching 1.25 EH/s by late summer. In tandem, the company secured a $20 million credit facility from Coinbase Credit Inc., reinforcing its treasury and expanding financial flexibility. KULR also continues to grow its ASIC leasing business, recently deepening partnerships with a U.S.-listed firm to support treasury management.

CEO Michael Mo emphasized the firm’s dual-pronged “buy-or-mine” approach to Bitcoin acquisition, which enables KULR to adapt to volatile market conditions. This adaptability, combined with increased mining capacity and strategic financial backing, positions KULR as an emerging player in the global Bitcoin mining sector.

Kaynak: news.bitcoin.com

Russia Moves to Ban Bitcoin Mining in Data Centers to Prioritize AI Development

Russia is preparing to ban cryptocurrency mining in officially registered data processing centers (DPCs), as part of a broader effort to support the country’s push for AI and big data infrastructure. New provisions inserted into a draft law, initiated by President Putin, aim to prevent Bitcoin miners from exploiting electricity subsidies and fast-track energy access intended for data centers that support national digitalization goals. Once passed, the law will bar DPCs from hosting any crypto mining activity and will classify them as communication facilities under a new registry maintained by the Ministry of Digital Development.

The government argues that crypto miners have drained energy resources in certain regions, jeopardizing the power supply and undermining incentives designed for AI and tech development. With over a dozen regions already banning mining since 2024, this marks a significant escalation in Russia’s evolving stance on crypto infrastructure. Industry analysts warn the ban could harm both the mining sector and the data center industry, given that many operators run hybrid facilities. If enacted, the new law would deal a blow to major players like BitRiver, whose operations are intertwined with DPC services.

Kaynak: cryptopolitan.com

Russia and China Gain Ground as U.S. Hashrate Share Slips Slightly

As Q3 begins, the latest global Bitcoin mining map reveals subtle but important changes in mining power dynamics. The United States retains its lead with 35.81% of the global hashrate, equivalent to 323.4 EH/s, but this marks a small drop of 0.60% since late May. In contrast, Russia posted a significant 6.12% gain, rising to 16.61% of global share, roughly 150 EH/s. China also edged up to 13.84% with 125 EH/s. These movements show a tightening race for mining dominance, particularly as geopolitical strategies and energy access come into play.

Other notable players include Paraguay (3.87%), the UAE (3.54%), Oman (2.99%), and Canada (2.935%). While North America, parts of Europe, and Asia dominate the map, vast swaths of Africa and Central Asia remain inactive or underrepresented. The visual data points to a growing imbalance in mining distribution, and as the quarter progresses, Russia’s sharp rise may be the most telling sign of an impending reshuffle in the global mining hierarchy.

Kaynak: bitcoin.com