Sommaire

- Aperçu du réseau

- DL Holdings to Enter Bitcoin Mining With $22M Convertible Bond Deal

- Russia Holds Off on Expanding Crypto Mining Ban

- Laos Weighs Crypto Mining to Monetize Surplus Hydropower

- Armenia Floats State-Backed National Bitcoin Mining Plan

- Opinion: Radical Transparency Could Make Mining Crypto’s Compliance Anchor

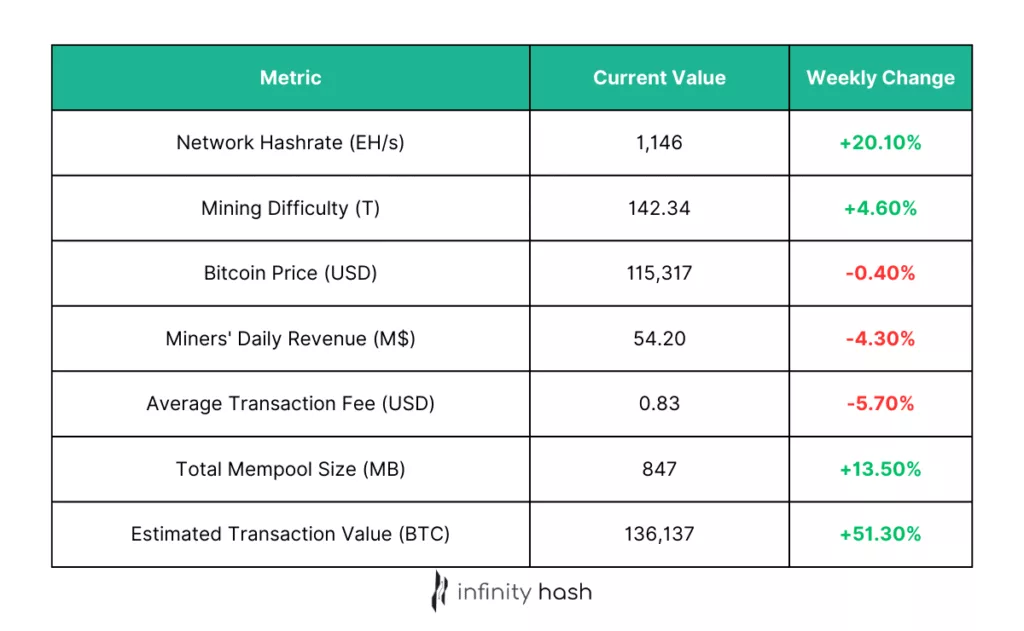

Aperçu du réseau

Compute power snapped back up even as difficulty notched higher, a sign that new capacity is coming online at a fast rate, with large operators still expanding (think rapid build-outs like Hive’s hydro site and the wave of modular gear announcements). But that same difficulty grind kept margins tight: hashprice eased over the month, fees cooled a touch, and miner top-line slipped despite a mostly flat coin price.

On-chain, settlement value climbed, consistent with whales and treasuries reshuffling after recent profit-taking and miner reserve sales. Policy and supply-chain headlines remain a headwind: tariff disputes and potential US security reviews for foreign rig makers raise cost and sourcing risk, while authorities continued cracking down on power theft from Brazil to Hong Kong. The arms race favors efficient fleets and cheap energy; everyone else is still in a squeeze.

DL Holdings to Enter Bitcoin Mining With $22M Convertible Bond Deal

Hong Kong–listed DL Holdings has announced its entry into Bitcoin mining through a partnership with Fortune Peak, backed by a $21.85 million convertible bond issuance. The financing will cover the purchase of over 2,000 Bitmain S21XP HYD miners, adding more than 1 EH/s of capacity.

The company expects to mine roughly 200 BTC per year and build a treasury exceeding 4,000 BTC within two years, aiming to position itself as Hong Kong’s first publicly listed “hashrate stock.” Alongside the bond, DL Holdings will issue warrants and performance-based shares, underscoring its long-term commitment. Management sees the move as a way to diversify revenues and balance sheet exposure as institutional interest in Bitcoin continues to rise.

Source : beincrypto.com

Russia Holds Off on Expanding Crypto Mining Ban

Russia’s Ministry of Energy has confirmed it sees no need to broaden the country’s crypto mining restrictions, citing stable electricity supplies and no new requests from regional governors. While mining remains banned in several energy-strained regions until 2031, the federal government is signaling a more measured approach, preferring localized solutions over sweeping prohibitions.

Deputy Minister Yevgeny Grabchak suggested regulatory amendments could offer alternatives to outright bans, such as reclassifying miners into a lower-priority electricity category that would allow temporary disconnections during peak demand. For now, Russia’s stance provides relief for operators, affirming the country’s role as a key global mining hub while acknowledging the ongoing balancing act between industry growth and grid stability.

Source : cryptopolitan.com

Laos Weighs Crypto Mining to Monetize Surplus Hydropower

Laos is exploring licensed cryptocurrency mining to soak up excess electricity from its dam build-out, a move aimed at easing debt and attracting investment as the country pushes a 2030 “digital economy” agenda. Officials frame mining as a way to convert stranded hydro into exportable revenue after Chinese operators migrated post-2021, but reliability is seasonal and the grid has previously cut power to farms during drought and export peaks.

Critics highlight unresolved social and environmental costs from dam projects alongside macro risks of high public debt, inflation, and a weakening kip. If approved, the plan would test whether hydro-backed mining can deliver fiscal relief without worsening energy shortfalls or community impacts.

Source : coinpaper.com

Armenia Floats State-Backed National Bitcoin Mining Plan

Prime Minister Nikol Pashinyan has called for establishing a national-level Bitcoin mining facility, framing it as a strategic push to diversify the economy, attract investment, and channel domestic energy resources into digital infrastructure. The proposal envisions a state-supported buildout positioning Armenia to participate directly in the global Bitcoin network while developing data-center expertise.

Officials and observers note the upside comes with familiar hurdles: ensuring reliable, preferably renewable, power; crafting clear rules and security standards; addressing environmental and community impacts; and funding specialized infrastructure at scale. Lessons from peers (e.g., El Salvador’s geothermal model and Kazakhstan’s grid strains) suggest careful pacing and energy policy will determine whether a national mine becomes an engine of growth or a burden on the grid.

Source : bitcoinworld.co.in

Opinion: Radical Transparency Could Make Mining Crypto’s Compliance Anchor

A guest essay argues that miners can bolster crypto’s legitimacy by embracing auditable operations—publish energy mix and hashrate, verify facilities, enforce KYC/AML on hosting clients, and adopt clear policies on neutrality vs. filtering. The piece notes recent enforcement wins (e.g., DOJ ransomware seizures) and U.S. guidance affirming PoW mining isn’t a security as tailwinds for treating miners as regulated infrastructure rather than speculative actors. Sustainability and security are framed as core: disclose efficiency and curtailment participation, and harden monitoring, treasury hygiene, and incident response.

The warning is equally sharp: opaque ownership and cloud-mining schemes remain red flags that invite fraud and regulatory backlash. The takeaway is that transparency isn’t a PR choice but an existential requirement, mining’s credibility sets the tone for the whole stack, from institutions to policymakers.

Source : cryptoslate.com