Sommaire

Aperçu du réseau

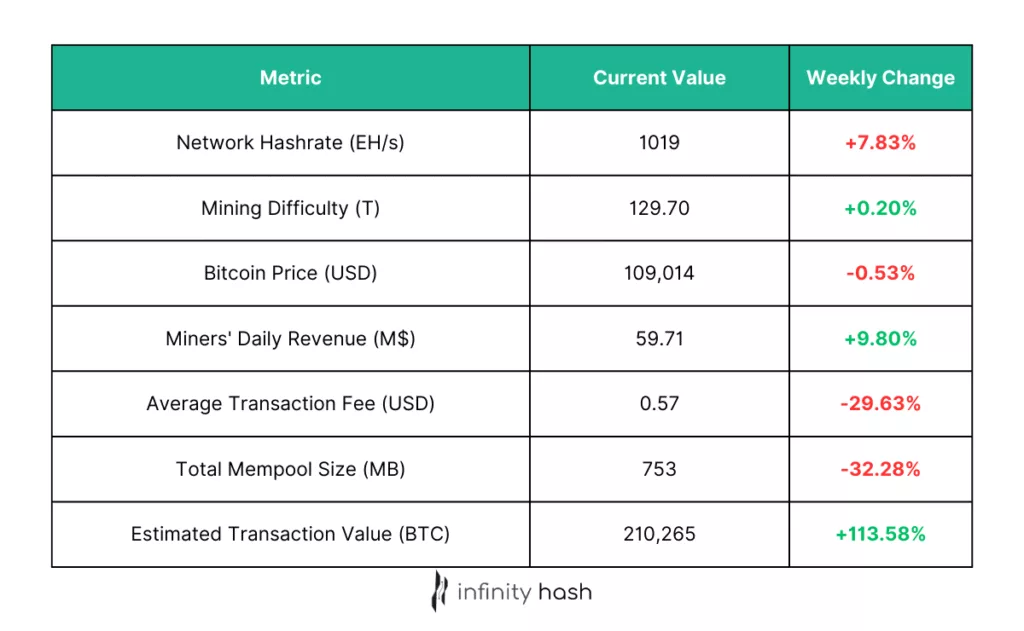

On-chain activity spiked this week as whales booked one of the largest profit-takings since February, likely driving the sharp rise in transaction value. At the same time, miners sold off nearly half a billion dollars in BTC to cover costs, a sing of financial struggle. Meanwhile prices edged lower, suggesting both whales and miners are cashing out into weakness rather than strength. This combination points to short-term headwinds, with large holders trimming positions while miners offload reserves under margin pressure.

Bitcoin Enters the Zettahash Era

Bitcoin’s network hashrate briefly topped 1 zettahash per second (ZH/s) this week, marking the first time miners collectively sustained one sextillion hashes per second. The milestone reflects the immense scale of computing power securing the network, though it also sets the stage for a projected 6% difficulty increase at the next adjustment.

Mining pool concentration remains high, with Foundry, Antpool, and ViaBTC collectively controlling over half of the network’s compute. As zettahash performance becomes the new baseline, competition will hinge on access to efficient hardware and cheap energy, raising the pressure on smaller operators while reinforcing the advantage of well-capitalized players.

Source : bitcoin.com

Bitcoin Miners Sell $485M in BTC Amid Profitability Squeeze

Miner wallets shed over 4,200 BTC across a 12-day span, the fastest pace of outflows in nine months. The sell-off comes after a period of reserve accumulation earlier this year and reflects tighter margins as rising difficulty and weaker on-chain demand have eroded profitability. Hashprice has slipped back toward midyear levels, leaving even efficient operators under pressure.

Despite the outflows, fundamentals remain strong with network hashrate near record highs and block production stable. Analysts note that miner selling alone is not enough to destabilize the market, but combined with whale profit-taking and growing competition from AI-focused infrastructure, the trend underscores a cautious mood across the sector.

Source : cointelegraph.com

Bitcoin Mining Revenues Slide as Hashprice Declines

Hashprice has dropped 7.6% over the past month, cutting daily miner earnings even as network hashrate stays near record highs. The latest difficulty adjustment nudged levels to 129.7T, with block times averaging under ten minutes and another increase projected for early September. While revenue per petahash has slipped, the downturn is cushioned by the use of more efficient hardware keeping hashrate resilient.

The trend underscores the ongoing squeeze on miner margins: rising difficulty and softer transaction demand are weighing on profitability even as the network continues to operate at unprecedented scale. With another upward adjustment likely, the balance between efficiency, costs, and rewards remains the key challenge for operators.

Source : bitcoin.com

Block Inc. Launches Proto Rig to Challenge Bitmain’s Hardware Monopoly

Jack Dorsey’s Block Inc. has unveiled the Proto Rig, a modular mining system developed with Core Scientific and aimed at reducing downtime and maintenance costs. Unlike conventional rigs, the Proto Rig emphasizes repairability and seamless upgrades, allowing parts to be swapped in seconds. The design borrows from decades of data center best practices, shifting the industry conversation from chip specs to overall reliability and profitability.

Block says the system is vertically integrated, including its own ASIC chip with efficiency ratings as low as 14.1 J/TH, though full details remain undisclosed. Manufacturing is expected to lean increasingly on U.S.-based production, incentivized by tariffs and supply chain reliability goals. With Bitmain still controlling over 80% of the global hardware market, the Proto Rig’s modular and customizable approach represents one of the strongest bids yet to diversify Bitcoin mining hardware supply.

Source : bitcoinmagazine.com

Hut8 Announces Major US Expansion and Strengthens BTC Treasury

Hut8 has unveiled plans for four new development sites across Louisiana, Illinois, and Texas, adding 1,530 MW of potential capacity to its infrastructure. Once completed, the projects will lift the company’s managed capacity to 2.5 GW across 19 sites, supporting both Bitcoin mining and AI data centers. The dual-purpose expansion highlights Hut8’s strategy of diversifying revenue streams while scaling its mining footprint.

The company also reinforced its financial position with confirmation that it holds 10,278 BTC, valued at roughly $1.2B. Alongside its credit facility and equity program, this treasury provides liquidity and stability against market volatility. Hut8’s combination of infrastructure growth and long-term BTC holdings positions it as a significant player at the intersection of mining and AI-driven compute demand.

Source : bitcoinworld.co.in