Contenidos

- Visión general de la red

- Illegal Bitcoin Mining Expands in Central Asia

- Trump-Backed Miner Orders 16K Bitmain ASICs Amid Tariff Pressures

- Block Launches Modular Bitcoin Mining System ‘Proto Rig’ and Management Software

- Google-Backed AI Hosting Deal Gives TeraWulf Path to 8% Stake Acquisition

- China Denies AI-Generated Rumors of Guizhou Official’s Bitcoin Mining

- Bitcoin Hashrate Falls from Record High as Difficulty Increases

- Qubic Claims 51% Control of Monero, Raising Network Security Concerns

- Ethiopia to Phase Out All Crypto Mining to Protect Power Supply

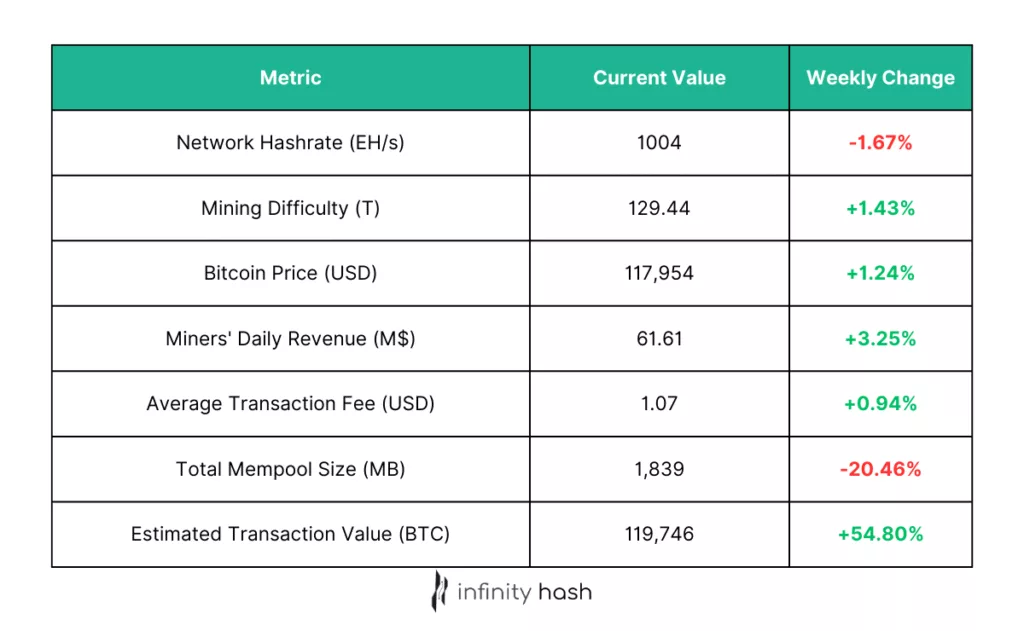

Visión general de la red

Network conditions this week were shaped by a fresh difficulty increase following the recent hashrate peak, which has slightly affected mining profitability. Despite this, miner revenues improved as Bitcoin’s price continued to climb, supported by a generally bullish market tone. Transaction activity also saw a surge in value transferred on-chain, and fee levels ticked higher. This combination of steadier throughput and improved price action helped offset the revenue pressures from higher difficulty.

Illegal Bitcoin Mining Expands in Central Asia

Tajikistan’s Attorney General reported $3.52M in H1 2025 damages tied to illicit crypto mining, mainly from stolen electricity. Authorities have several open criminal cases and, in the Sughd region alone, seized 135 devices across residential sites linked to ~$30,000 in losses. The crackdown mirrors developments in Kazakhstan, where a joint probe found energy company employees diverted more than 50 MWh of grid power to mining farms over two years. Proceeds allegedly funded real-estate and car purchases now subject to confiscation. Mining isn’t explicitly illegal in either country, but Kazakhstan has tightened rules, requiring miners to source power via the Ministry of Energy.

Analysts attribute the trend to patchy enforcement and unclear legal frameworks that continue to pull operators from abroad. After China’s 2021 ban, Central Asia became a fallback, and experts say Russian actors have also used parts of the regional crypto ecosystem. Even aggressive restrictions rarely eliminate activity entirely. China’s estimated mining share fell sharply but persisted, leaving smaller, under-the-radar operations to exploit cross-border networks and weak oversight.

Fuente: descifrar.co

Trump-Backed Miner Orders 16K Bitmain ASICs Amid Tariff Pressures

American Bitcoin, a mining firm backed by members of President Donald Trump’s family, has ordered 16,299 Antminer U3S21EXPH units from Bitmain, adding 14.02 EH/s of capacity at a cost of ~$314M. The purchase, which could expand to 17,280 units, was finalized earlier this month and shields the buyer from price hikes tied to new US trade tariffs on China-made mining hardware. In response to these tariffs, Bitmain plans to open its first US-based ASIC manufacturing plant by the end of 2025, alongside a new headquarters in Florida or Texas.

With over 99% of global mining hardware production concentrated among Bitmain, MicroBT, and Canaan, the tariffs are already prompting manufacturers to explore US-based operations. Supporters say the policy could help reshore production, but critics warn it may drive up costs for US miners, weaken domestic demand, and push hardware abroad at lower prices. Bitmain remains dominant with ~82% global market share, and industry leaders caution that tariff-driven supply shocks could reshape the competitive landscape for both miners and manufacturers.

Fuente: cointelegraph.com

Block Launches Modular Bitcoin Mining System ‘Proto Rig’ and Management Software

Jack Dorsey’s Block has unveiled the Proto Rig, a modular, repairable, and upgradeable mining system designed to extend hardware lifespans from the typical 3–5 years to as much as a decade. Built for rapid, tool-free repairs and component-level upgrades, the system allows operators to replace individual hashboards without dismantling entire units. Block says the design can deliver 1.5× the power per rack-foot versus conventional rigs, while cutting upgrade costs by 15–20% per cycle and reducing downtime.

Alongside the hardware, Block introduced Proto Fleet, a free, open-source management platform that integrates diagnostics, monitoring, power scaling, and maintenance tools. Usable both on-premises and in the cloud, it supports operations from small setups to industrial-scale farms. The initiative is part of Block’s push to make mining infrastructure more accessible, durable, and decentralized, aiming to strengthen network resilience and reduce dependence on short-lived, single-use equipment.

Fuente: cryptobriefing.com

Google-Backed AI Hosting Deal Gives TeraWulf Path to 8% Stake Acquisition

TeraWulf has signed two 10-year high-performance computing colocation agreements with AI cloud platform Fluidstack, backed by Google, to provide over 200 MW of liquid-cooled AI infrastructure at its Lake Mariner campus in New York. The contracts, worth up to $8.7B with extensions, will see Google backstop $1.8B of Fluidstack’s lease obligations to support project financing. In return, Google gains warrants to purchase ~41M TeraWulf shares, representing an 8% pro forma equity stake.

The project’s first 40 MW phase is slated for H1 2026, with full buildout by year-end 2026 at an estimated $8–10M per MW. TeraWulf CEO Paul Prager said the deal unites top-tier capital and compute partners to deliver next-generation AI infrastructure powered largely by zero-carbon energy. Fluidstack’s leadership highlighted the venture’s role in scaling rapid, high-performance compute for leading AI labs. TeraWulf’s stock (WULF) surged over 46% intraday on the news.

Fuente: cryptobriefing.com

China Denies AI-Generated Rumors of Guizhou Official’s Bitcoin Mining

The Guizhou Provincial Commission for Discipline Inspection has denied claims that former Big Data Bureau director Jing Yaping used government servers to mine 327 BTC, calling the reports AI-generated misinformation. Authorities stated her case was unrelated to cryptocurrency, countering unverified online allegations that had circulated widely. The clarification avoided potential market impact, following Beijing’s zero-tolerance stance on both unauthorized mining and the spread of false information.

Officials stressed the importance of verifying news from credible sources, especially in the crypto sector where unsubstantiated reports can influence market sentiment. While China has previously prosecuted public officials for illicit mining, no precedent matches the alleged scale of this rumor. Industry leaders have yet to comment, but the episode highlights ongoing regulatory vigilance in a country that maintains strict enforcement against illegal mining.

Fuente: coincu.com

Bitcoin Hashrate Falls from Record High as Difficulty Increases

Bitcoin’s seven-day average hashrate hit a record 976 EH/s on Aug. 8 before retreating to around 900 EH/s following a 1.42% difficulty increase at block height 909,216. That adjustment set a new all-time high difficulty of 129.44T, marking the 11th rise this year and a 17.73% cumulative gain for 2025 despite five prior downward moves. The latest hike followed the sharp hashrate surge earlier in the month, but block times have since slowed to an average of 11:04, indicating a potential relief in the next adjustment cycle.

Current estimates point to a possible difficulty decrease of 9.64% by Aug. 24 using recent averages, or 1.77% by Aug. 29 under the formal schedule, depending on how block production trends in the coming days. Softer difficulty settings could entice sidelined rigs back online, helping restore the 10-minute block target. However, analysts note that sustained Bitcoin price strength, which has lifted hashprice 2.55% in four days to $58.76 per PH/s on BTC’s move above $120K, remains the more decisive factor for keeping miners engaged.

Competitive pressure remains intense, with 16 difficulty changes already recorded in 2025. Frequent upward adjustments have made block rewards harder to capture, pushing operators toward peak efficiency while magnifying the risks of price pullbacks. Mining remains heavily concentrated among the top five pools: Foundry, Antpool, Viabtc, F2pool, and Spider Pool, which together control 78.39% of global block production.

Fuentes: bitcoin.com, bitcoin.com

Qubic Claims 51% Control of Monero, Raising Network Security Concerns

Monero is facing a major decentralization challenge after Qubic, led by IOTA co-founder Sergey Ivancheglo, claimed it now controls over 51% of the network’s hashrate. The move gives Qubic the theoretical ability to reorganize the chain, double spend, or censor transactions. Describing the action as a “strategic experiment,” Qubic said it used economic incentives and its “useful proof-of-work” model of converting Monero block rewards to USDT and using them to buy and burn QUBIC tokens to attract miners away from other pools. Monero’s XMR price fell 6% in 24 hours, extending a 13.5% weekly drop, as traders weighed the risk of sustained outside control.

From under 2% of Monero’s hashpower in May, Qubic’s share rose to 25% by late July before surpassing the majority threshold this week. Security experts warned that while sustaining the attack could cost ~$75M per day, it could also quickly erode confidence and drive other miners offline. Qubic says it has not fully taken over consensus to avoid damaging XMR’s value but maintains the experiment demonstrates how coordinated incentives can centralize mining on a supposedly ASIC-resistant network.

Fuente: coindesk.com

Ethiopia to Phase Out All Crypto Mining to Protect Power Supply

State-owned Ethiopian Electric Power (EEP) has announced plans to gradually shut down all cryptocurrency mining operations in the country, halting new contracts and reconsidering existing ones. The move follows growing public pressure over energy use, with mining data centers projected to consume roughly one-third of Ethiopia’s total electricity output in 2025: around 8 TWh. Officials argue the power could be better allocated to exports, electrification, and strategic sectors like agriculture.

EEP CEO Asheber Balcha said domestic consumers and key industries remain the top priority, noting millions of Ethiopians still lack reliable access to electricity despite miners paying about $0.0314 per kWh. Half of EEP’s current revenue is being directed to the Koysha Hydropower Project, the country’s second-largest dam, which faces funding delays. The decision marks a significant policy shift for Ethiopia, which had attracted miners with low tariffs but now joins other nations reassessing the sector’s impact on energy security.

Fuente: cryptopolitan.com